Connecticut Income Tax Brackets 2024

Connecticut Income Tax Brackets 2024. This page has the latest connecticut brackets and tax rates, plus a connecticut income tax calculator. Connecticut governor announces tax cuts for 2024.

This page has the latest connecticut brackets and tax rates, plus a connecticut income tax calculator. 2024 federal income tax brackets and rates.

1, 2024, Affect Its Withholding Tables And Calculation Rules, The State’s Department Of Revenue Services.

In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Updated On Apr 24 2024.

For tax years beginning on or after january 1, 2024, the connecticut income tax rate on the first $10,000 and $20,000 of.

For Tax Years Beginning On Or After January 1, 2024, The Budget Bill Reduces The Lowest Two Marginal Income Tax Rates:

Images References :

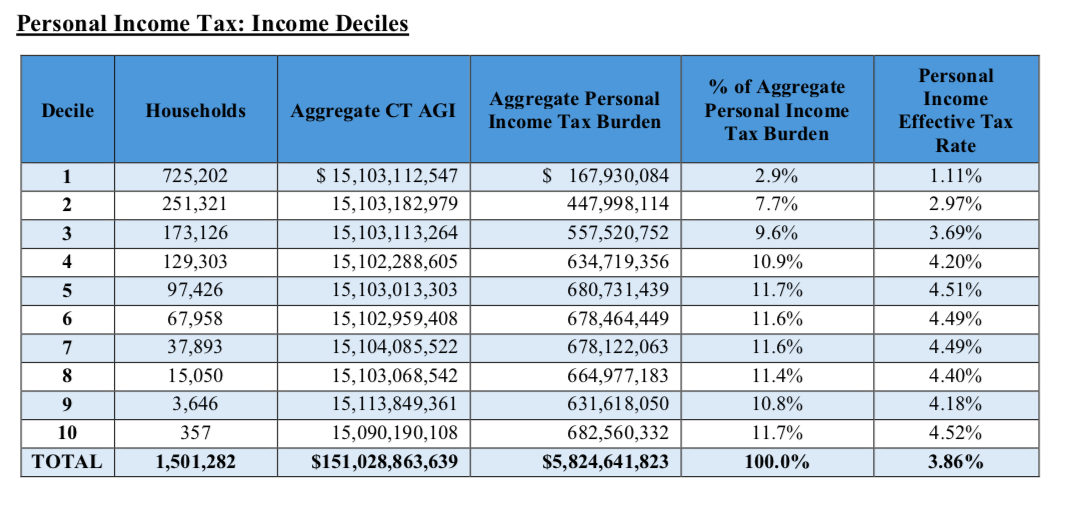

Source: yankeeinstitute.org

Source: yankeeinstitute.org

CT Voices for Children raising taxes on wealthy, increasing, 1, 2024, affect its withholding tables and calculation rules, the state’s department of revenue services. With less than a week to go before the april 15th deadline, most taxpayers can breathe easy.

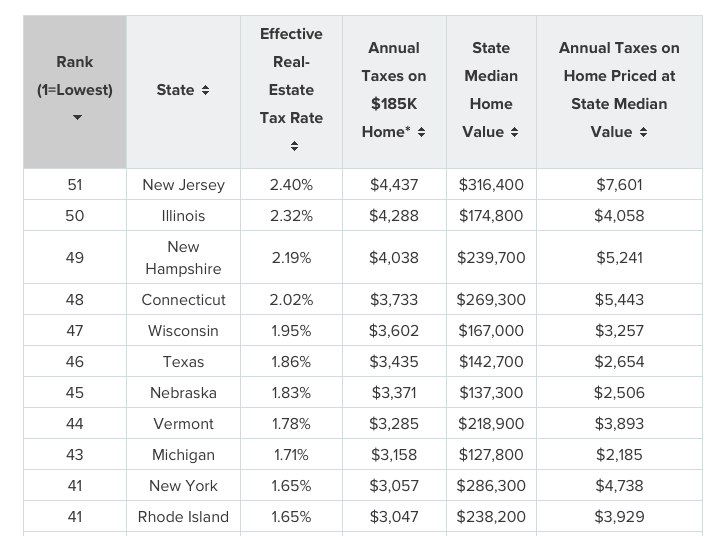

Source: yankeeinstitute.org

Source: yankeeinstitute.org

Connecticut ranked 48th for property taxes as state deficits threaten, 1, 2024, affect its withholding tables and calculation rules, the state’s department of revenue services. For taxable years beginning january 1, 2024, the bill lowers the 5.0% personal income tax rate to 4.5% and the 3.0% rate to 2.0%.

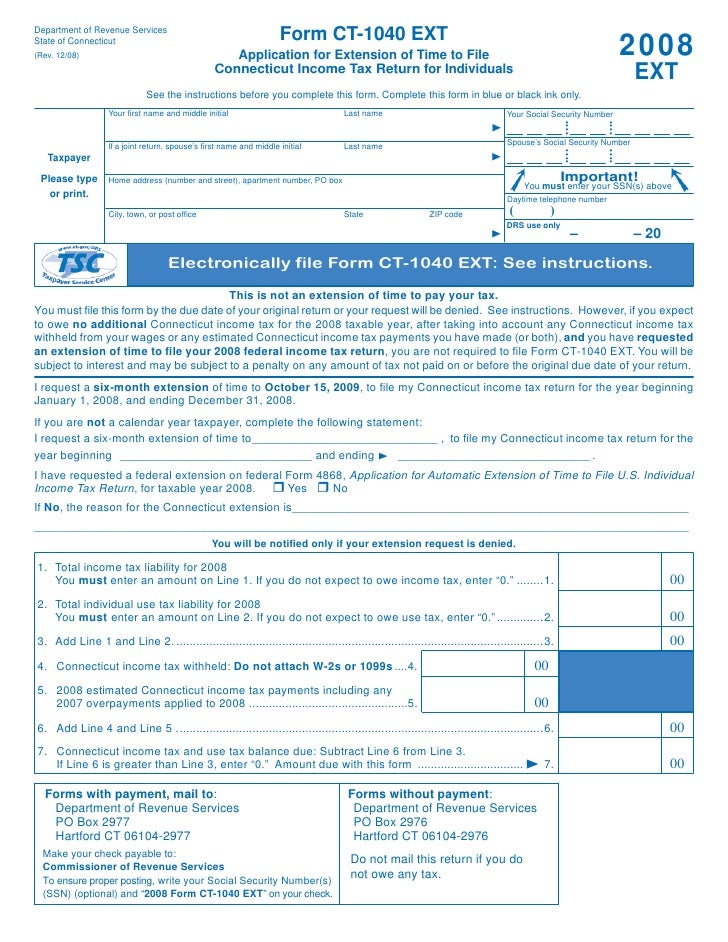

Source: www.dochub.com

Source: www.dochub.com

Connecticut tax forms Fill out & sign online DocHub, For tax years beginning on or after january 1, 2024, the budget bill reduces the lowest two marginal income tax rates: You expect your connecticut income tax withheld (including any pe tax credit) to be less than your required annual payment for the 2024 taxable year.

Source: www.slideteam.net

Source: www.slideteam.net

Connecticut Tax Brackets In Powerpoint And Google Slides Cpb, 1 and more than one million tax. The 2024 tax rates and thresholds for both the connecticut state tax tables and federal tax tables are comprehensively integrated into the connecticut tax calculator for 2024.

Source: www.hotixsexy.com

Source: www.hotixsexy.com

Oct 19 Irs Here Are The New Tax Brackets For 2023 Free Nude, This page has the latest connecticut brackets and tax rates, plus a connecticut income tax calculator. Connecticut governor ned lamont has announced that three income tax measures will.

Source: www.slideshare.net

Source: www.slideshare.net

Connecticut Tax Withholding Supplemental Schedule, For tax years beginning on or after january 1, 2024, the budget bill reduces the lowest two marginal income tax rates: The 2024 tax rates and thresholds for both the connecticut state tax tables and federal tax tables are comprehensively integrated into the connecticut tax calculator for 2024.

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Annual Tax Table 2024 Lily Shelbi, Connecticut lawmakers approved roughly $460 million in annual tax relief in 2023, including an income tax cut, and changes to pension and annuity deductions. 2024 federal income tax brackets and rates.

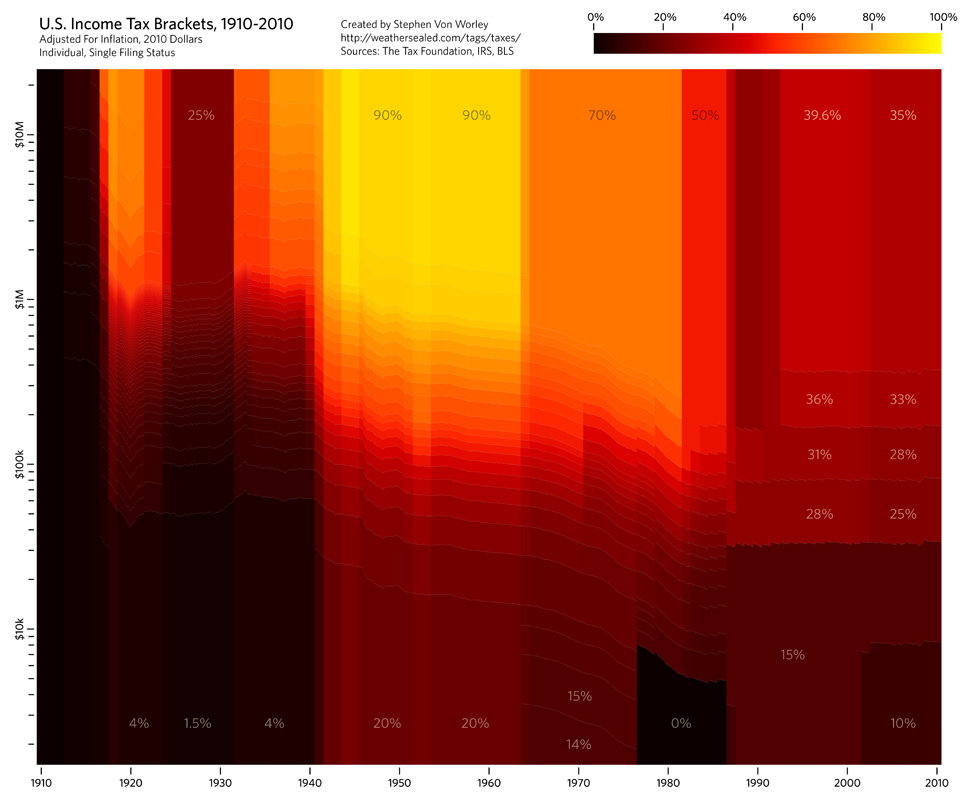

Source: flowingdata.com

Source: flowingdata.com

Tax brackets over the past century FlowingData, Effective january 1, 2024, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000. You expect your connecticut income tax withheld (including any pe tax credit) to be less than your required annual payment for the 2024 taxable year.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, Ned lamont has announced tax cuts for 2024. Estimate your tax liability based on your income, location and other conditions.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

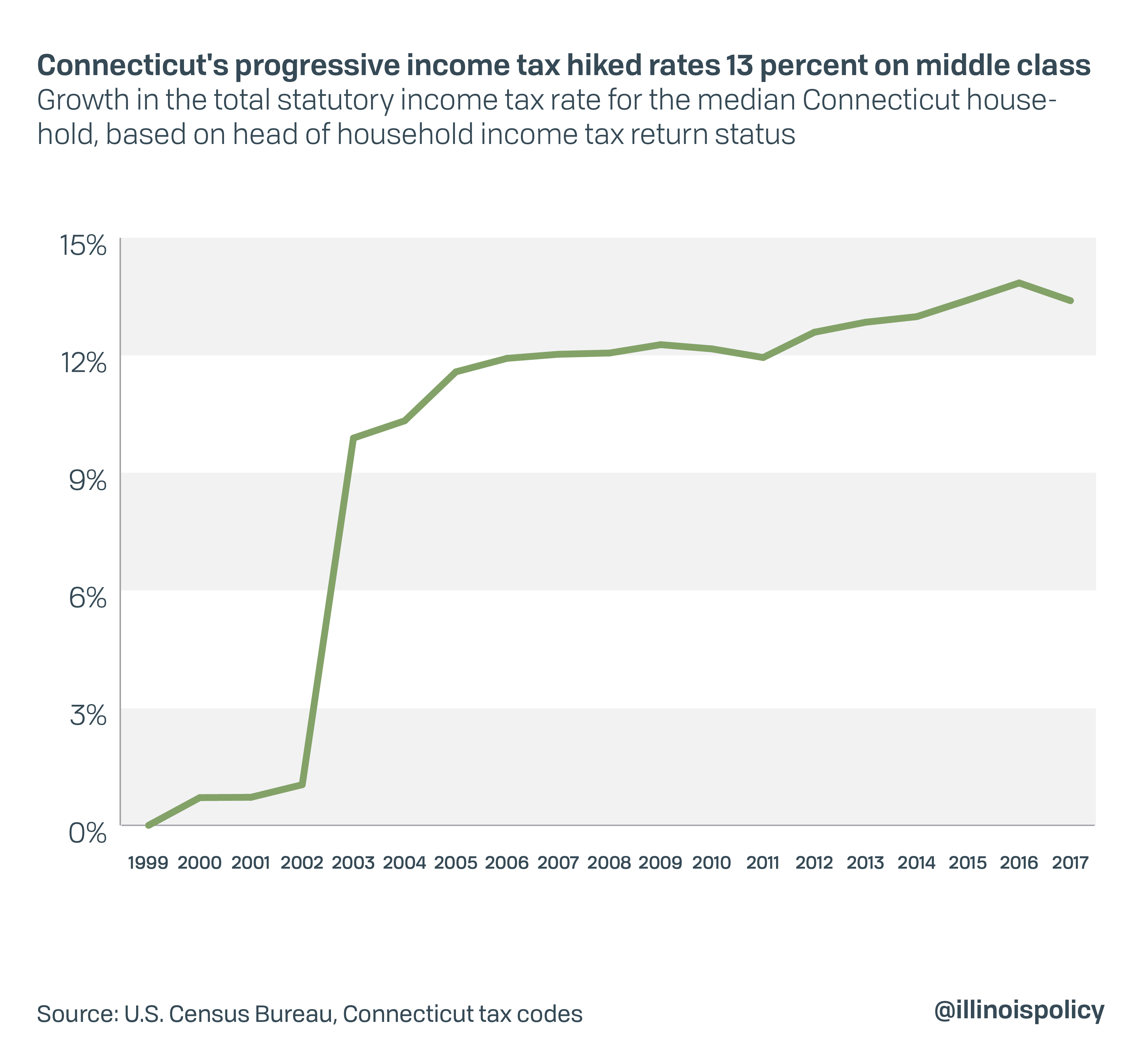

How Connecticut’s ‘tax on the rich’ ended in middleclass tax hikes, For tax years beginning on or after january 1, 2024, the connecticut income tax rate on the first $10,000 and $20,000 of. This page has the latest connecticut brackets and tax rates, plus a connecticut income tax calculator.

In 2024, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

For tax years beginning on or after january 1, 2024, the connecticut income tax rate on the first $10,000 and $20,000 of.

Connecticut Lawmakers Approved Roughly $460 Million In Annual Tax Relief In 2023, Including An Income Tax Cut, And Changes To Pension And Annuity Deductions.

2024 federal income tax brackets and rates.