Iowa 529 Plan Limit 2024 College

Iowa 529 Plan Limit 2024 College. How much you should have in a 529 plan to save for college for your children by age, including high and low contributions for public and private school. In addition to the new tax deduction amount, iowa’s 529 account owners now will be able to transfer up to a lifetime limit of $35,000 to a roth ira in the.

While funding a 529 plan has long been a great way for families to contribute to save for. Recent state legislation has increased the tax deduction amount up to $5,500 for contributions to iowa’s two 529 plans, college savings iowa and the iadvisor 529.

Iowa 529 Plan Limit 2024 College Images References :

Source: lillaqkrystyna.pages.dev

Source: lillaqkrystyna.pages.dev

Maximum 529 Plan Contribution 2024 Alys Lynnea, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary.

Source: ireneqoralla.pages.dev

Source: ireneqoralla.pages.dev

Iowa 529 Limits 2024 Myrah Tiphany, As a participant, you will pick investments, choose a beneficiary and determine how, and when, the money is used.

Source: devondrawletty.pages.dev

Source: devondrawletty.pages.dev

Iowa 529 Plan Tax Deduction 2024 Lotti Rhianon, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary.

Source: www.collegesavingsiowa.com

Source: www.collegesavingsiowa.com

Cost of college College Savings Iowa 529 Plan, Making contributions is easy by logging in through our website or with the readysave 529 app.

Source: dadmba.com

Source: dadmba.com

Beginner's Guide to 529 College Savings Plan Dad MBA, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2024, Although these may seem like high caps, the.

Source: www.youtube.com

Source: www.youtube.com

3 Reasons to Use the Iowa 529 Plan YouTube, College savings iowa funds can be used as a qualified withdrawal for fees, books, supplies and equipment required for participation in an apprenticeship program registered and.

Source: www.youtube.com

Source: www.youtube.com

WHAT'S A 529 COLLEGE SAVINGS PLAN & HOW DOES IT WORK???!! YouTube, State tax deduction or credit for contributions:

Source: www.dkarndtcpa.net

Source: www.dkarndtcpa.net

Benefits of an Iowa 529 College Advantage Plan for Kids’ & Grandkids, In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

Source: www.collegesavingsiowa.com

Source: www.collegesavingsiowa.com

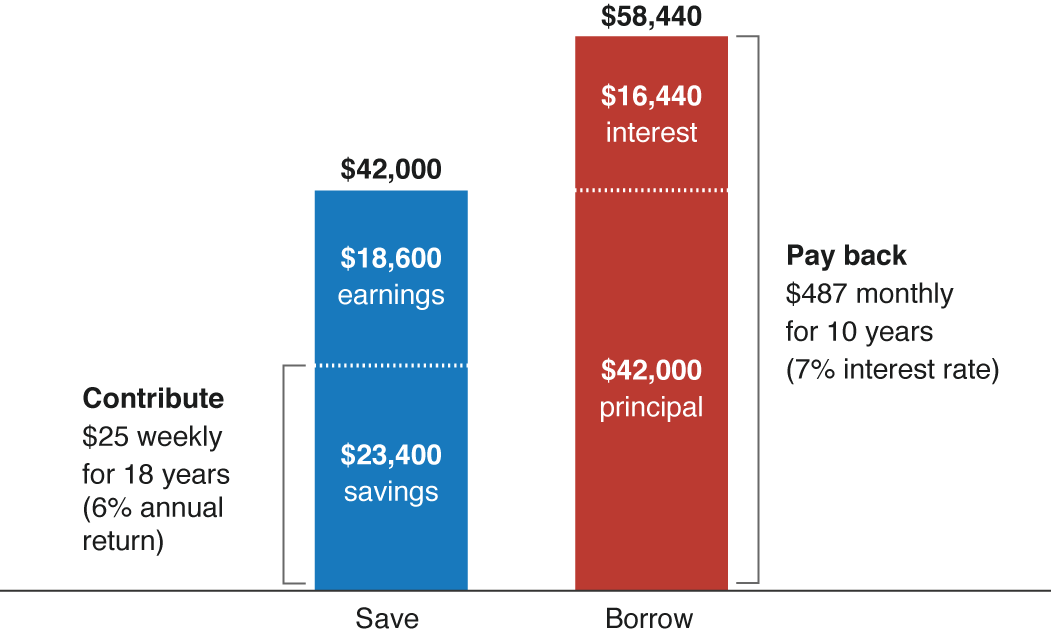

Paying for college Saving vs. borrowing College Savings Iowa 529 Plan, Although these may seem like high caps, the.

Category: 2024